Hotel financial statements are vital documents that provide an overview of financial data, including revenue, expenses, profit and loss. The documents also break down financial data based on the different departments.

For hotels, such statements are valuable for understanding and assessing financial health. They can also be used to inform strategies and identify relevant trends, making it easier to plan for the future.

In this article, you can gain an understanding of what hotel financial statements are, why they matter and what the key elements are. You will also find information on best practices and common challenges hoteliers face.

Table of Contents:

- What Are Hotel Financial Statements?

- Why Hotel Financial Statements Are Essential for Business Success

- 6 Key Hotel Financial Statements for Effective Management

- 5 Best Practices for Analyzing Hotel Financial Statements

- 4 Common Challenges and Solutions in Hotel Financial Reporting

- Essential Components of Hotel Financial Statements

- Key Metrics and Ratios in Hotel Financial Statements

- Hotel Invoice Management: Optimizing Financial Record-Keeping

- Hotel Financing: Strategic Approaches to Acquiring Capital

What Are Hotel Financial Statements?

Hotel financial statements are documents that outline the financial activities of hotels and similar businesses. Examples of financial statements include balance sheets, cash flow statements, revenue reports and more.

Financial reporting in the hotel industry has been standardized by the Uniform System of Accounts for the Lodging Industry (USALI). Hotel financial statements also break down financial reporting by department.

As a result, hotel financial statements can provide an overview not only of the financial health of a hotel business, but also of the financial performance of individual hotel teams and areas of operation.

Why Hotel Financial Statements Are Essential for Business Success

Hotel financial statements are critical for transparent hotel operations and provide visibility into the financial health of a business. This allows stakeholders to easily access an abundance of useful performance data.

Using this information, you can make strategic decisions around hotel operations, using real evidence to inform your choices. For those in hotel management, financial statements also provide insights into strengths and weaknesses.

These documents can be important for compliance and responsible budgeting. Additionally, by breaking down financial statements on a departmental basis, you can better understand which hotel departments are profitable and where revenue and costs are stemming from. Then, you can make strategic adjustments and allocate resources responsibly.

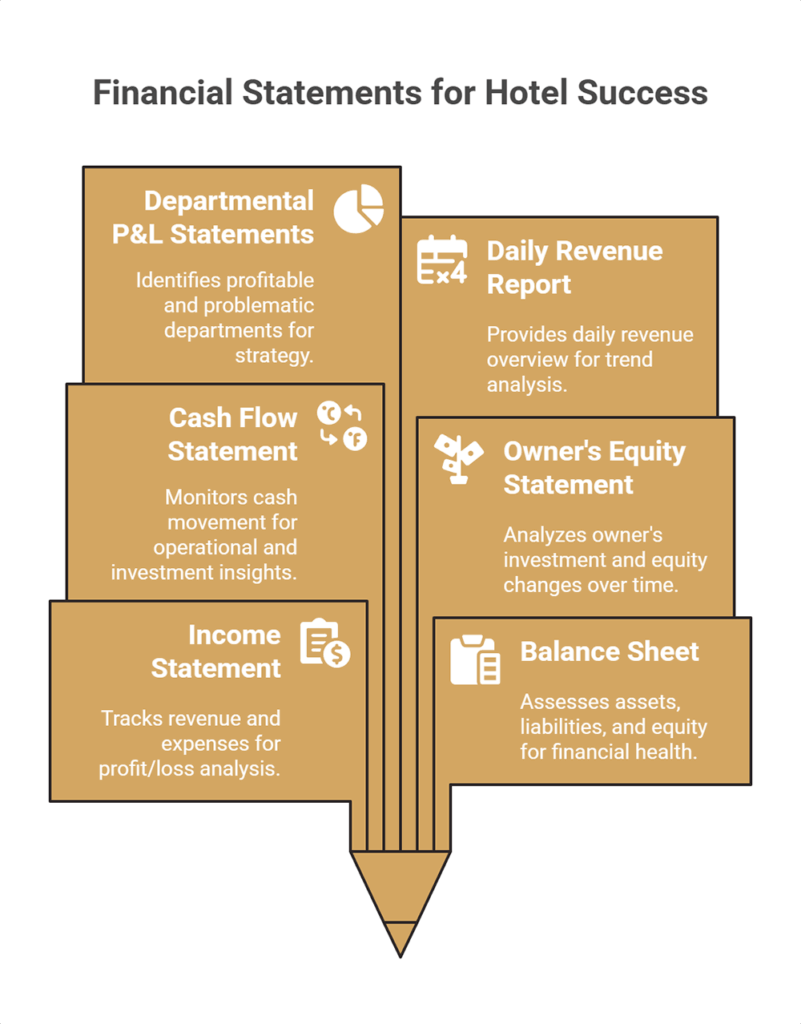

6 Key Hotel Financial Statements for Effective Management

There are a variety of different hotel financial statements that help you to track performance and make evidence-based decisions. In these sections, you can explore some of the most vital statements:

1. Income Statement (Profit and Loss)

A hotel income statement is a breakdown of your property’s financial performance. It documents all of the revenue earned and all of the expenses incurred over a defined period.

Income statements are some of the most important hotel financial statements because they factor in all earnings and all costs. Crucially, they also provide visibility into whether the hotel is operating at a profit or loss.

In accordance with the USALI, these documents also break down profit and loss by department. This allows hotel management to more specifically target their efforts to improve financial performance.

2. Balance Sheet

A balance sheet offers a quick look at the current financial position of your hotel. Sometimes called a statement of net worth, it includes assets, liabilities, and owner’s equity.

Essentially, your balance sheet is important for demonstrating what your hotel owns and what it owes. It provides useful information to stakeholders and potential investors about current debt levels and liquidity ratios.

A balance sheet covers current assets, fixed assets, money owed to suppliers, tax liabilities, and equity and capital information. The document allows hotel management to understand whether the business is in a healthy enough financial position to meet obligations, remain solvent and achieve future growth.

3. Cash Flow Statement

A cash flow statement is a statement covering the movement of money in and out of your hotel over time. It breaks this cash flow down into three main areas: operating activities, investing activities and financing activities.

Within the hotel industry, cash flow statements are critical for understanding the actual cash realities of your business. They also offer insights into how money is generated and used across all business activities.

Within these hotel financial statements, you will find a breakdown of cash flow related to day-to-day hotel operations, long-term asset acquisitions, and financing activities like borrowing and debt repayments.

4. Statement of Owner’s Equity

A statement of owner’s equity is a financial overview of activities related to the owner’s investment in your hotel. It also covers how the owner’s equity has shifted over time, such as increases or decreases.

This document is important for monitoring the ways profits are allocated and the current state of the business’ equity position. It is especially valuable to potential investors, but provides current stakeholders with transparency too.

Key features of a statement of owner’s equity document include capital contributions and retained earnings. With this and other hotel financial statements, possible investors can understand the viability of your business.

5. Departmental Profit and Loss Statements

Departmental profit and loss statements break down earnings, expenses, profits, and losses for each individual hotel department. As a result, you can see which departments are profitable and how profitable they are.

These hotel financial statements are essential for identifying the hotel departments that have financial problems. Using this information, you can make strategic changes to minimize losses and maximize profits.

In addition, you can use this information to understand which departments are the most profitable and why. From there, you can potentially extract useful insights that can inform strategy in other departments.

6. Daily Revenue Report

A daily revenue report is an overview of the revenue generated across all departments and hotel room types in a 24-hour period. It is a dynamic document, as the financial results can differ significantly from one day to the next.

Daily revenue reports are among the most crucial hotel financial statements because they can function as an early indicator of problems. By tracking these statements, you can spot dips in financial performance quickly.

At the same time, the daily nature of these statements means they are prone to sudden changes. Rather than reacting to a single daily revenue report, it usually makes sense for hotel management to track trends over time.

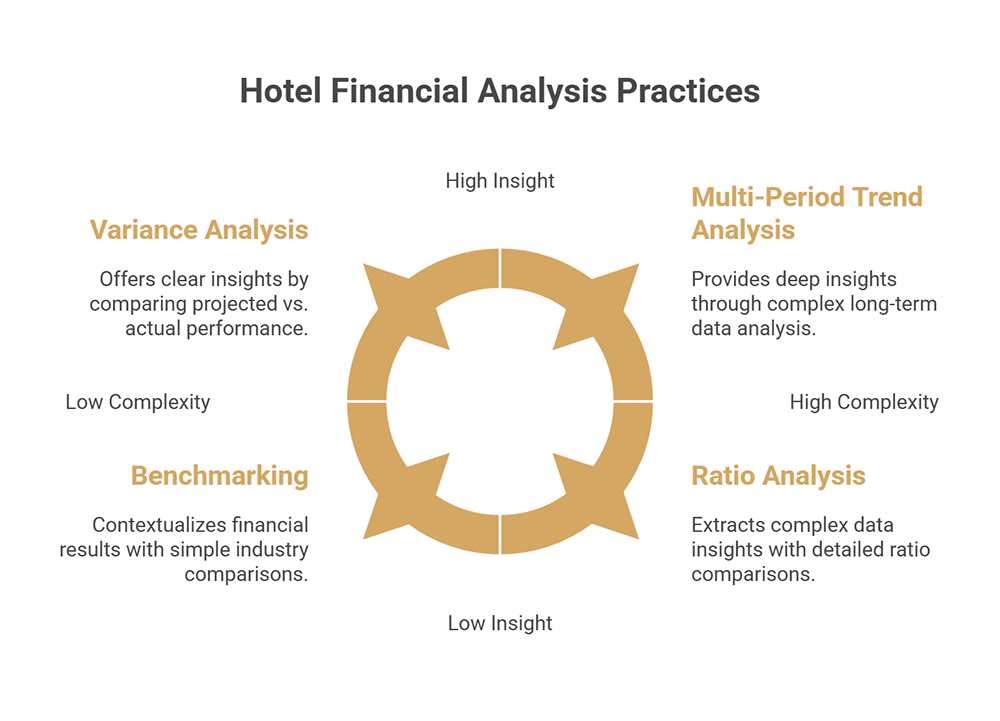

5 Best Practices for Analyzing Hotel Financial Statements

Here, you can explore some of the best practices for analyzing your hotel financial statements, extracting actionable insights and improving the operational performance of your accommodation property.

Video: Fundamentals Of Hotel Financial Statements And Analysis

1. Conduct Regular Variance Analysis

Within the field of finance and hotel financial statements, variance analysis is the comparison of projected performance with actual performance. This allows you to understand where real-life performance differs from expectations.

Variance analysis helps hotel management to identify areas of performance that require investigation. From there, it becomes easier to understand the root cause of any major discrepancies between projections and real outcomes.

By carrying out this kind of analysis regularly, you can also gain a deeper understanding of the accuracy of your projections. This might help you to address any underlying shortcomings that may affect results.

2. Implement Benchmarking Against Industry Standards

Benchmarking involves comparing the metrics in your hotel financial statements against industry standards. This may include other hotels in your competitive set, national hotel averages, global industry averages and more.

By making these comparisons, you can contextualize your financial results. Benchmarking also allows you to better understand your position within the wider hotel industry and whether you are underperforming or overperforming.

Benchmarking is crucial for framing your financial results within wider market realities. For example, if industry averages are down across the board, it provides much-needed context for deterioration or improvement in your performance.

3. Utilize Ratio Analysis for Deeper Insights

Ratio analysis is a means of interpreting hotel financial statements through comparison of different ratios and percentages. It is an approach that focuses on three main areas: profitability, efficiency and liquidity.

The main benefit of this kind of analysis is the ability to extract deeper and more meaningful insights from raw data. This can give you a clearer sense of your business’s overall financial health.

Over time, you can track trends within the ratios and percentages you collect. However, the most meaningful insights are often extracted by looking at how different ratios relate to and influence one another.

4. Develop Multi-Period Trend Analysis

A multi-period trend analysis requires you to look at the data in hotel financial statements across multiple time periods. Doing so allows you to identify patterns and trends and base your judgments on long-term data.

Conducting multi-period trend analysis can help to add context that you will not gain from looking at data over a single period. This is especially important when trying to find cyclical or seasonal trends.

Some of the most common approaches involve comparing data from the same month every year, or looking at year-to-year figures. You can also break down the year into quarters and compare financial data from one quarter to the next. Alternatively, you can compare the same quarter year after year, such as comparing Q1 results this year to Q1 last year.

5. Implement Departmental Profitability Assessment

A departmental profitability assessment will analyze the various hotel financial statements on a departmental level. It helps you to determine the profitability of hotel departments and their overall contribution to success.

This process helps you to evaluate each of your hotel departments and their ability to generate a profit. It also allows you to compare different departments in terms of the profit margins they are achieving.

Financial results for each department can also be compared with historic performance, so you can understand which departments are improving and which are not. You should also try to factor in different departmental contexts too. For example, some departments may be set up to generate profit, while others are set up to prioritize guest experience.

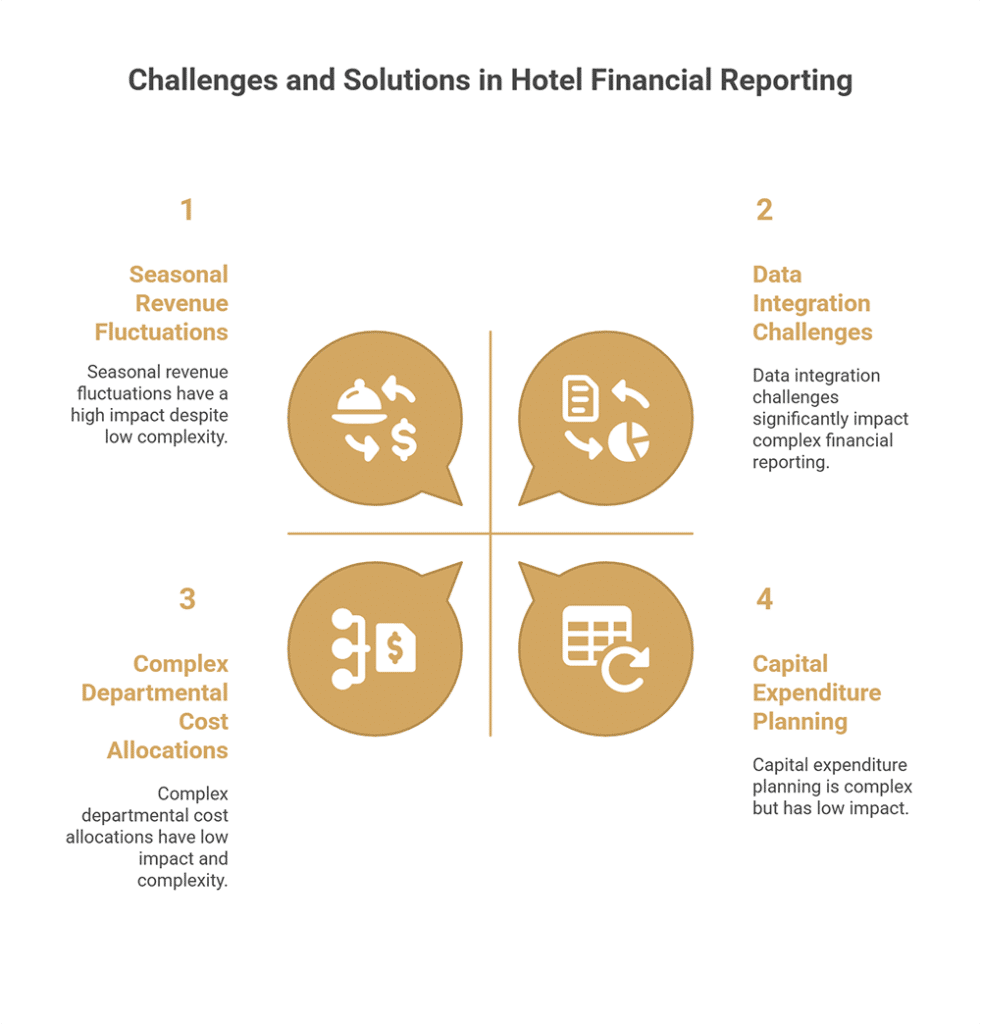

4 Common Challenges and Solutions in Hotel Financial Reporting

In this section, you can explore some of the common challenges you may encounter when producing and interpreting your various hotel financial statements, along with possible solutions.

Video: Hotel Financials: 101 with the Financial Coach David Lund

1. Seasonal Revenue Fluctuations

Seasonal revenue fluctuations are the changes in revenue patterns that hotels experience at different times of the year. It is common for destinations to have both a high season and a low season, with revenue varying significantly.

This presents a challenge because hotels may notice a sudden increase or decrease in revenue. In the moment, it can be difficult to know if this is due to operational changes or these wider cyclical patterns.

To address this issue, it is important to conduct a year-over-year comparative analysis. This is more revealing than simple month-by-month comparisons, allowing you to understand changes in revenue within the wider context.

2. Complex Departmental Cost Allocations

Hotels have a number of shared expenses, such as electricity, water and heating costs. While all departments within a hotel are likely to use utilities, they do not all use them evenly.

When it comes to creating hotel financial statements, it can be complicated to determine how these costs should be allocated across departments. One department, for example, may use much more water and electricity than another.

To overcome these challenges, you need to have clear processes in place for measuring cost contributions. For example, you may be able to allocate based on the physical space each department takes up, or by tracking utility usage.

3. Capital Expenditure Planning

Capital expenditure planning is focused on allocating financial resources for investment in long-term assets. This can include building renovations, along with equipment and technology replacements or upgrades.

Hotel financial statements need to provide stakeholders with a transparent picture of current circumstances. Doing so can be difficult when capital expenditure needs to be taken into account and understood.

To get around this, you should create capital replacement schedules, outlining when assets are going to be replaced and how much they are going to cost. This provides much-needed clarity to your stakeholders.

4. Data Integration Challenges

Hotel financial statements can present data integration challenges, related to obtaining data from multiple sources. It can also be challenging to consolidate this information and produce accurate reports.

Specific challenges can include obtaining data from POS systems, property management systems and workforce management systems. In some properties, the systems used may also differ across various hotel departments.

When possible, use standardized systems with integration built into the design. Make sure you are using platforms intended for hospitality businesses and are making use of automation options, when available, to reduce human error.

Essential Components of Hotel Financial Statements

Hotel financial statements consist of a number of crucial components that offer visibility into your business’ financial health and viability. The components below help you to continually assess performance:

- Revenue Analysis: Comprehensive hotel financial statements separate revenue based on hotel departments and market segments, making it easier to track and optimize revenue over time.

- Expense Categorization: Your hotel financial statements can classify expenses as fixed and variable costs, as well as direct and indirect costs. This allows you to more easily understand and control expenditure.

- Profitability Metrics: Tracking metrics like gross operating profit and departmental profit margins helps you to create hotel financial statements that truly measure financial success and efficiency.

- Asset and Liability Documentation: Monitoring assets like property and equipment, as well as liabilities like debt obligations, allows you to understand the strengths and potential weaknesses of your business.

- Cash Flow Tracking: Keeping an eye on the movement of money ensures you have a firm grasp on the cash realities of your hotel at any given time. This can help you to manage seasonal changes and financing.

- Comparative Analysis: Monitor your hotel financial statements and analyze them in comparison to other types of statements and previous statements of the same kind. This helps you to pinpoint trends and anomalies.

Key Metrics and Ratios in Hotel Financial Statements

Hotel financial statements rely on key metrics, performance indicators and ratios. Below, you can find an overview of some of the most critical metrics and how they can help your financial reporting:

- Occupancy Rate: The percentage of available rooms that have been allocated during a particular period. This helps to indicate demand for hotel rooms and gives clues about your revenue generating potential.

- Average Daily Rate (ADR): The average price paid by guests per occupied room. This metric helps to demonstrate the effectiveness of your pricing strategy over a specified period.

- Revenue Per Available Room (RevPAR): A breakdown of total room revenue divided by the total number of available rooms. Provides an overview of your hotel’s ability to generate money from room sales.

- Gross Operating Profit Per Available Room: Shortened to GOPPAR, it accounts for revenue and expenses to demonstrate how profitable your hotel is. The figure is broken down by the number of rooms available.

- Flow-Through Percentage: The percentage of incremental revenue that is ultimately turned into profit. It measures how well you control the increased expenditure required to generate extra revenue.

- Cost Percentages: A measure of the expenses of hotel departments, expressed as a percentage of related revenue. This allows you to set benchmarks when implementing a cost control strategy.

Hotel Invoice Management: Optimizing Financial Record-Keeping

Much like hotel financial statements, hotel invoices form part of your financial record-keeping. However, invoices are concerned with costs incurred by guests and serve as a document for breaking down these individual charges to create a final bill. The best hotels use robust invoicing systems to generate and store invoices.

In the “Hotel Invoice Guide: Essential Tips & Best Practices for Hotel Professionals” article, you will discover the key elements of a hotel invoice and strategies for optimizing invoice creation in your hotel.

Hotel Financing: Strategic Approaches to Acquiring Capital

One of the elements captured by your hotel financial statements will be the hotel financing you secure. This describes the capital needed to buy, build, renovate or expand a hotel. Possible sources of hotel financing include hotel loans, crowdfunding, government grants and financing from private investors.

In the “Hotel Financing: Learn How to Finance Your Hotel Business” article, you will find an overview of some of the most common financing methods and tips for successfully acquiring capital for your hotel.

Did You Like This Article about Hotel Financial Statements?

You might also be interested in the following articles:

- Hotel Budget Plan: Practical Budgeting Tips for Hoteliers

- Hotel Folio: Essential Guide for Effective Guest Billing Management

- Hotel Costs: A Complete Guide to Customer Costs and Fees

- Pricing Strategies to Increase Your Hotel Revenue

- Hotel Budget: Effective Budgeting Tips for Hoteliers

Hotel financial statements are essential documents for successful hotel management, providing valuable insights into profitability and operational performance. By making strategic use of these documents, you can take evidence-based decisions, optimize the performance of your hotel and prevent financial losses.

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment