The hospitality sector has long underestimated the influence of short-term rental accommodation on their operations, viewing it as a specialized lodging type that wouldn’t impact conventional hotel reservations. However, the swift expansion of short-term rentals, spearheaded by organizations like Airbnb and VRBO, has made an undeniable mark on the hotel industry.

The Importance of Short-Term Rental Bookings

There’s a growing intersection between the hotel and short-term rental sectors, with consumers weighing up both alternatives based on cost, facilities, and value when reserving accommodation.

Research has identified a relationship between the increase in short-term rental bookings and hotel demand, offering Revenue Managers an innovative technique to anticipate demand at their property.

The evidence reveals that short-term rental reservations tend to surge in most markets before hotel bookings. By being able to foresee demand shifts in your market before your competitors, you can get ahead regarding pricing and promotion strategies.

Understanding the Connection Between Airbnb Lodging Data and Hotel Demand

To understand this link between short-term rentals and hotels, the research compared Airbnb rentals with representative hotels in 29 key travel locations, using occupancy rates from August 2022 to February 2023.

Although both exhibited similar final occupancy, the timing of the uptick was distinct. Airbnb rentals experienced an earlier increase, whereas hotels saw a rise closer to the date of stay.

This is called “hotel pick-up lag” and is calculated by measuring the difference in lead time at which short-term rentals and hotels reached 5% occupancy.

Through the comparison of these two curves, a deeper understanding of the correlation between short-term rental accommodations and hotels was found.

Short-term rentals tend to secure bookings earlier than hotels, indicating an upsurge in market demand for hotels within the same area. Conversely, hotels tend to reach full capacity later than short-term rentals, but draw larger reservations in the final three weeks before the stay date.

This correlation can serve as a valuable instrument for Revenue Managers to detect emerging demand and modify their pricing strategies accordingly.

The 21-day point preceding the stay date seems to be a pivotal data point for numerous destinations, as it marks the moment when hotels match the occupancy level of the Airbnb market.

Visualizing Hotel Pick-Up Lag

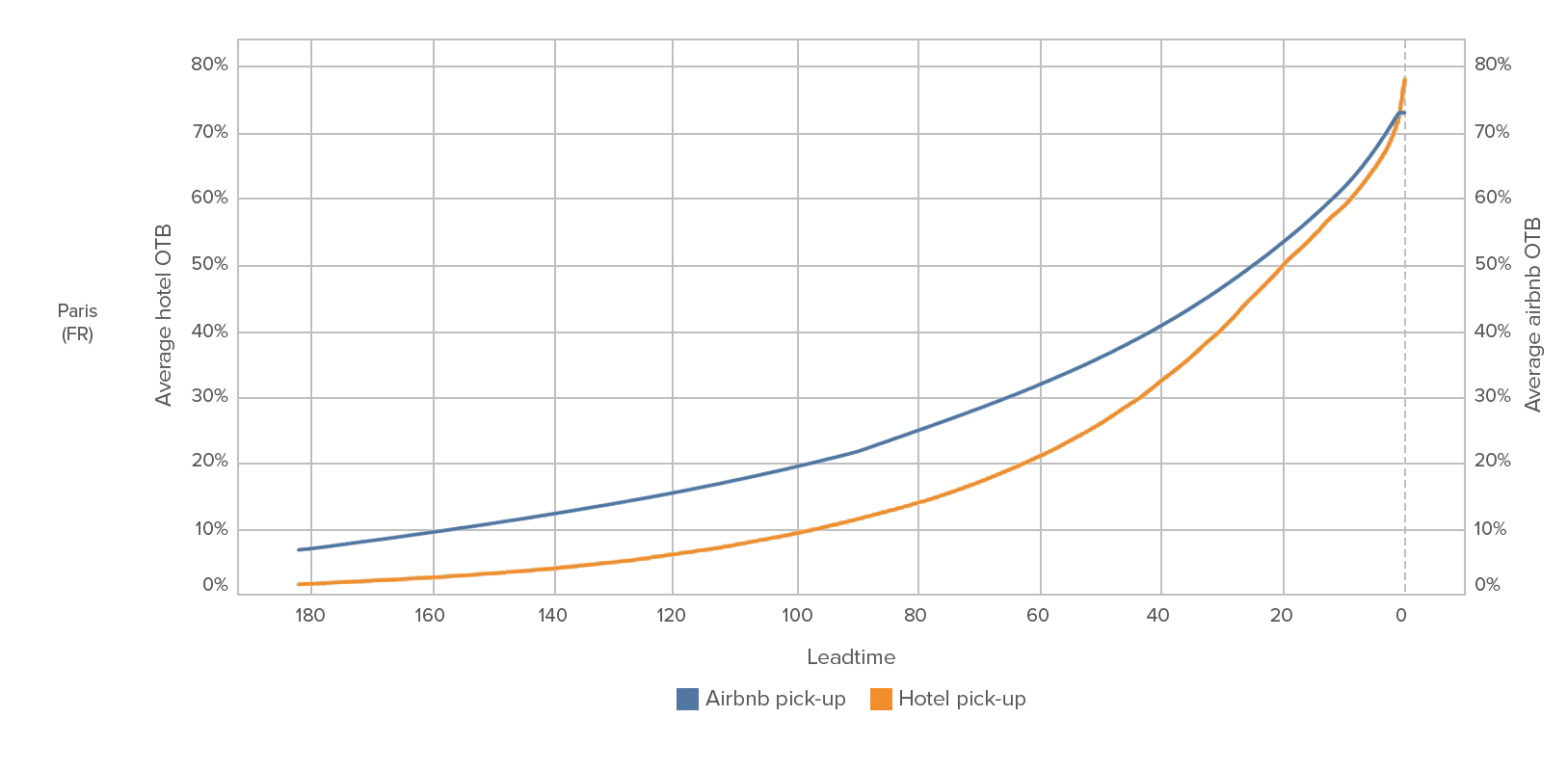

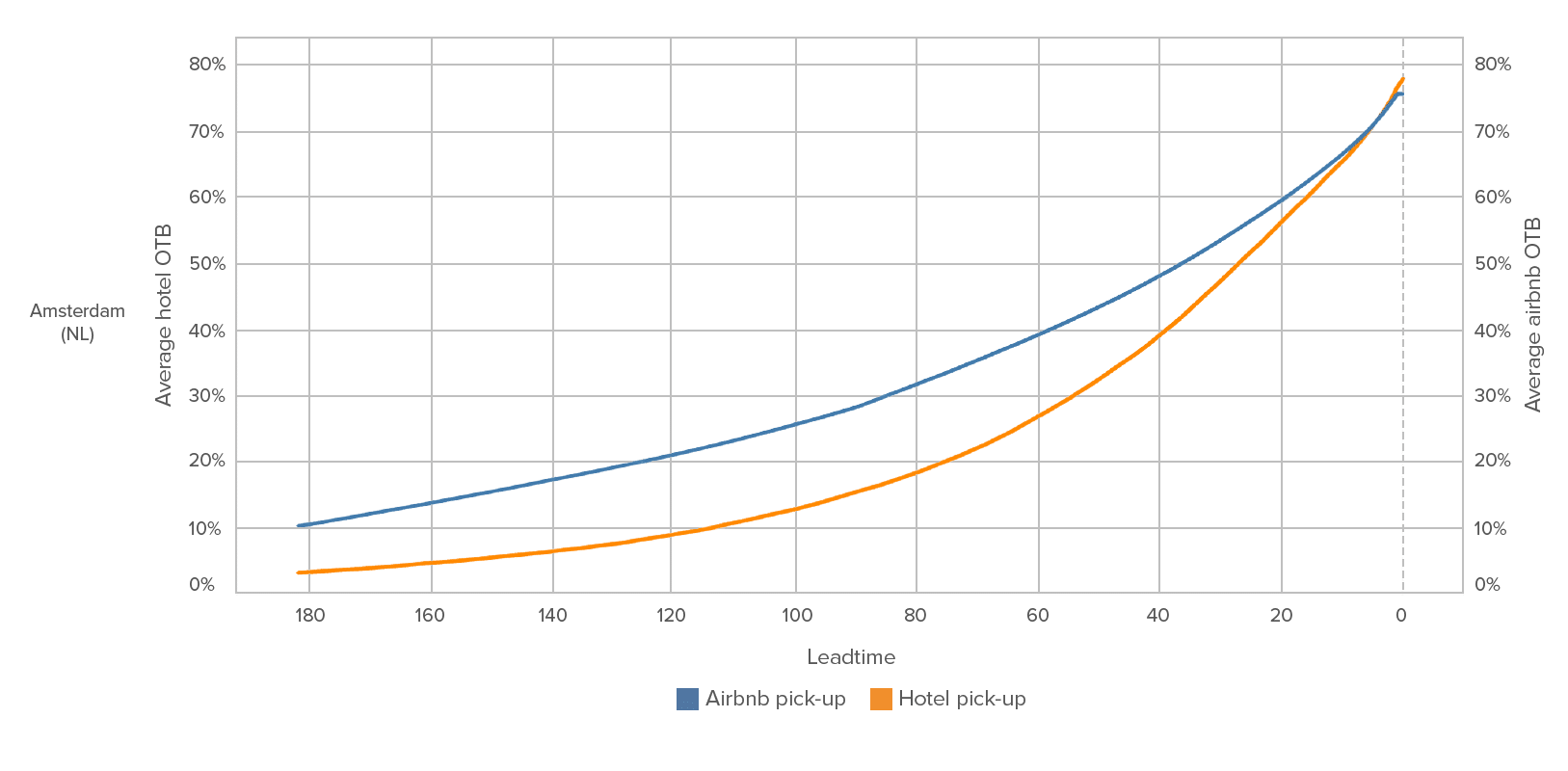

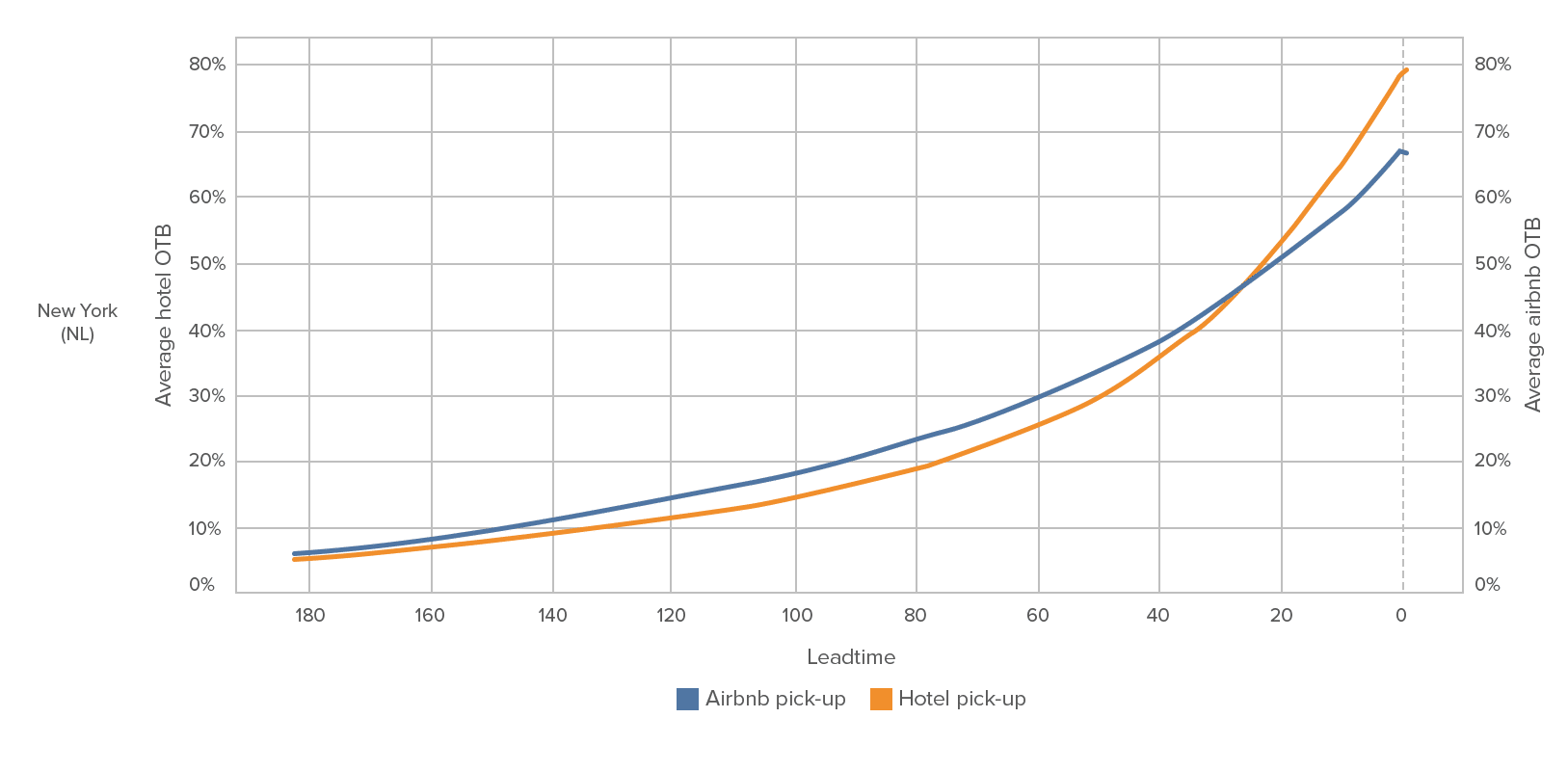

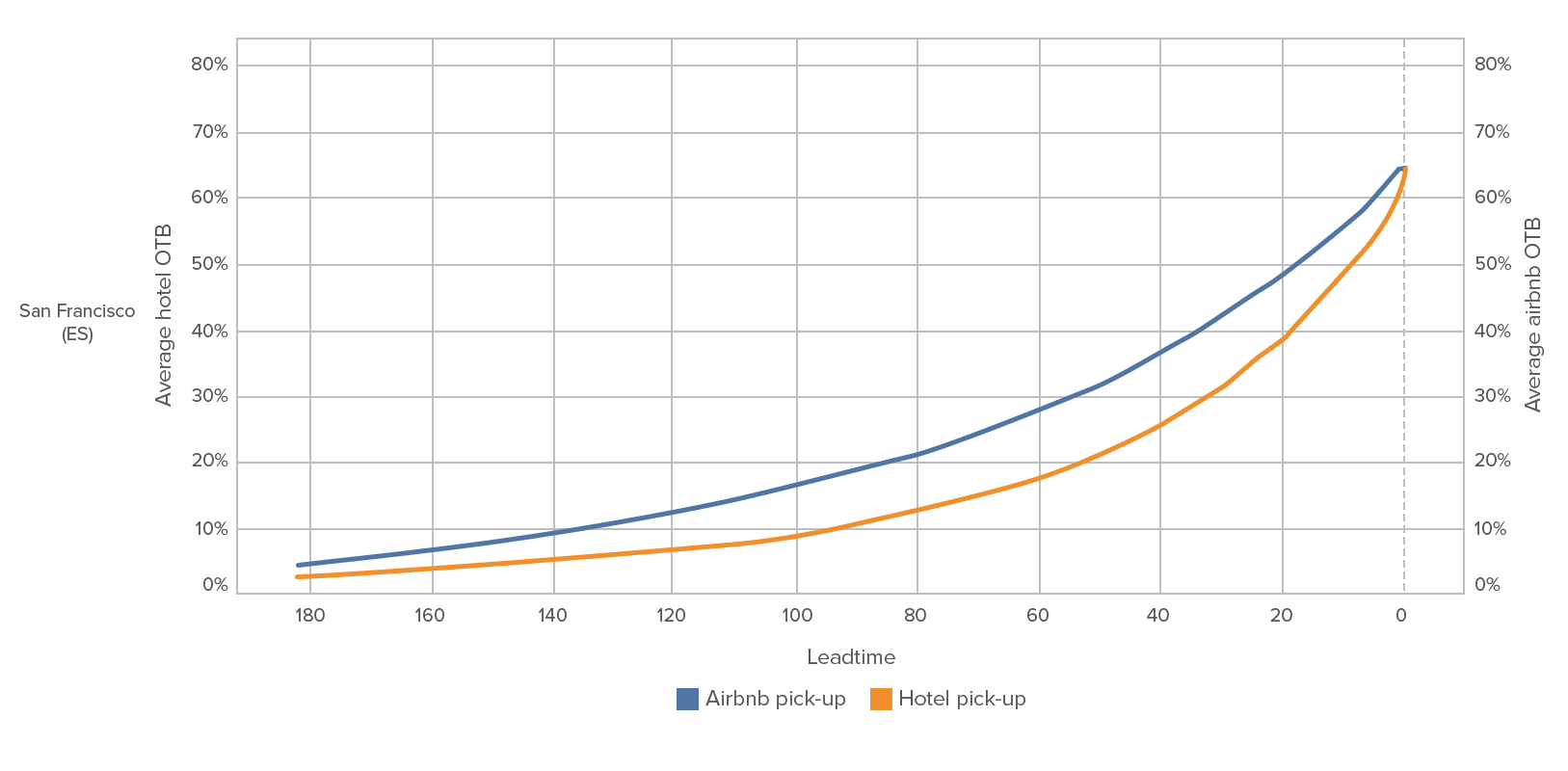

By examining the average proportion of accommodations booked over a given timeframe and plotting the lead time in days, you gain deeper insights into the relationship between short-term rental and hotel occupancy.

You can observe parallels in how short-term rentals and hotels mirror each other as the interval between booking and stay decreases.

The pattern for the two most correlated destinations, Paris and Amsterdam, can be seen below.

Paris has a hotel pick-up lag of 79 days, with the correlation of final occupancies in the city reaching 94%. Amsterdam has a hotel pick-up lag of 69 days, with the correlation of final occupancies in the city reaching 88%.

In all instances, the final share of rooms sold across the market aligns with or slightly surpasses short-term rental properties’ On-The-Book (OTB) reservation levels.

Two illustrative examples from New York City and San Francisco, are provided below. New York exhibits a hotel pick-up lag of 18 days, with the correlation of final occupancies in the city hitting 85%.

San Francisco, on the other hand, has a hotel pick-up lag of 44 days, with the correlation of final occupancies in the city achieving 83%.

Why Does Hotel Pick-Up Lag Vary in Certain Markets?

The initial analysis reveals a clear relationship between short-term rentals and traditional hotels, albeit one that can sometimes fluctuate across markets.

Certain markets, like Amsterdam and Paris, exhibit a strongly correlated positive relationship, while others display the inverse.

An example of this is the Maldives, where there is still a strong positive correlation, but the lag is negative, implying that hotels get booked before short-term rentals. In the Maldives, hotels usually began experiencing demand an average of 208 days ahead of their Airbnb counterparts.

While it is difficult to definitively explain this pattern and its geographical variations, there are some clues.

Large groups and high-end travelers might book Airbnb properties early, generating an earlier-developing curve, and then resort to hotels if needed. When hotels are booked earlier, it could be due to factors like customer profile, regulations, and property availability.

Destinations like Bangkok and Singapore exhibit weak correlations because of stricter short-term rental regulations for private properties. The Maldives has limited availability of genuinely alternative accommodation, which influences the market structure. These outliers show the importance of market structure in this metric.

Therefore, a degree of caution is recommended, but the potential for establishing a connection between the two is evident, as most destinations exhibit a strong relationship.

This is an intriguing discovery for the industry and offers valuable insights for Revenue Managers to refine their commercial strategies.

Tools to Predict Demand

With the rapid growth, professionalization, and increasing market share, short-term rentals have become a formidable hotel competitor. The problem is that hoteliers have not had a solution to truly understand this new competitor until now.

Tools like Lighthouse’s Rate Insight provide a view of your competitive landscape by combining hotel and short-term rental data. This results in better pricing decisions and gives you a competitive edge by providing a new method for demand forecasting.

Using the insights and strategies outlined can significantly enhance your competitive stance in the dynamic hospitality landscape. You can take advantage of emerging opportunities by proactively analyzing market trends and adjusting your business model accordingly.

Whitepaper: Predicting Hotel Demand with Short-Term Rental Data

This whitepaper will show you how to identify changes in short-term rental demand and adjust your pricing and marketing strategy for the appropriate periods ahead of your competition to accelerate growth.

Click here to download the whitepaper “Predicting Hotel Demand with Short-Term Rental Data”.

Leave A Comment