In the wake of the COVID pandemic, it is fair to say that the hospitality and tourism industry has been hit hard. It has dealt with an unprecedented economic fallout as international travel became restricted, flights reduced, events cancelled or postponed, and attractions and entertainment venues closed for extended periods. This article addresses whether hotels should remain open or suspend operations entirely during the pandemic based on Italian hotels’ performance in 2020.

2020 by the Numbers

A report by Federalberghi, the Italian Hotel Association, estimated losses in the range between 80% and 90% for 2020 compared to the previous year, and occupancy rates hovering between 10% and 20%.

This should give an idea of how severely hotels in art cities (such as Rome, Milan, Florence, Turin, Naples, etc.) were affected by the pandemic, even during the Summer, where figures lingered at low levels despite a brief respite from the virus lockdown leading to the easing of restrictions, the reopening of borders and the reinstatement of flights. However, as is the case with all summary statistics based on aggregate data, these numbers can only provide a general overview of the situation.

This is especially true of data and averages based on a large sample size, with generic qualitative criteria, clustering together a mix of hotels ranging from 3 to 5 stars, properties that always remained open and others that suspended operations temporarily or permanently, properties with an excellent online reputation (overall score of 8 and higher on Booking.com) and others with medium to low reputation (overall score below 8), properties that applied revenue management and others that did not, etc.

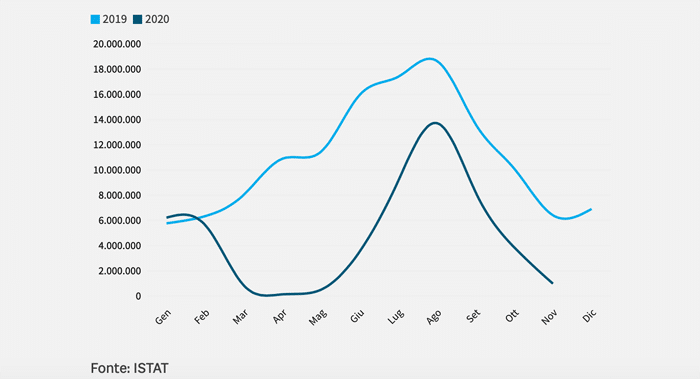

Boost of Bookings During the Summer Months

Indeed, the official figures provided by ISTAT (Italian National Institute of Statistics) on arrivals and overnight stays in Italy are conclusive evidence that the recovery that occurred in the Summer months of 2020 was nothing short of remarkable. As shown in the graph below, while arrivals and stays tumbled by more than 90% during March, April and May compared with prior-year levels, the improvement of the health situation and the easing of restrictions resulted in an exponential growth in demand from mid-June to October. Although still far below 2019 levels, it achieved narrowing the gap during July, August and September.

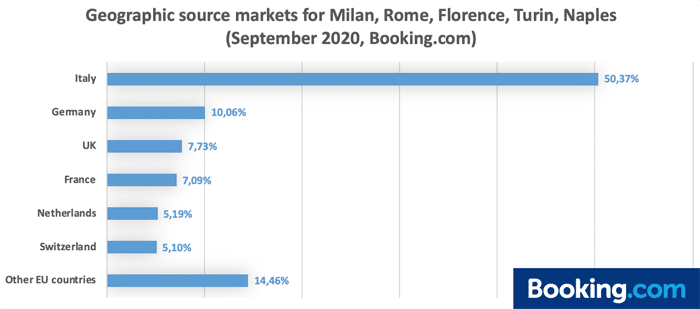

Lack of International Visitors

Seaside, mountain, and lakeside properties captured the lion’s share of this upsurge in arrivals and overnight stays (with the vast majority of visitors coming from within Italy and a small number from Europe). However, art cities also felt the positive impact of this recovery, albeit at somewhat reduced levels, due to increased demand from European countries, the latter accounting for nearly 50% of overall tourist arrivals in cities.

A Closer Look at the Data

Nevertheless, it is clear that these recovery’s effects were not equally dispersed across all city properties upon closer inspection.

While the figures reported by Federalberghi, based on aggregated data, can undoubtedly provide an accurate overall overview of how the pandemic impacted art and bleisure cities, by breaking down this data to its most granular level, additional layers of information come to light. It becomes clear that during the Summer, some hotels registered occupancy rates of between 60 and 80%, thus successfully preserving between 50 to 65% of revenue, compared to the prior year, while other hotels remained stagnant with an occupancy rate of between 10 and 20%. Conversely, the hotels that remained closed despite the positive epidemiological developments and the lifting of restrictive measures generated no revenue and sustained losses of 100%, year-over-year.

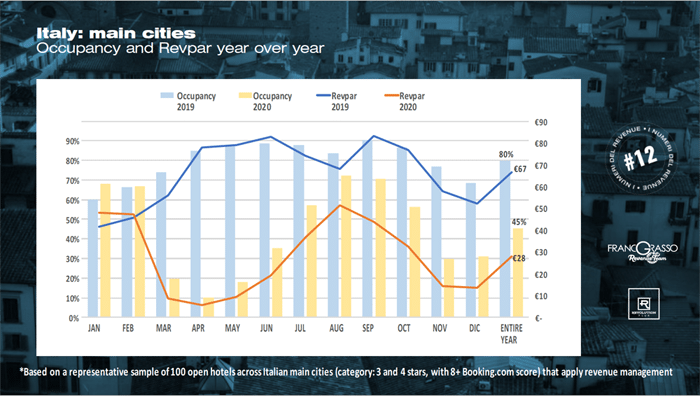

Occupancy and RevPAR Rates 2020 vs 2019

The chart below focuses on a sample comprising a mix of 100 properties that share the following characteristics: 3- and 4-star properties, located in major Italian cities (Rome, Milan, Florence, Turin, Naples, etc.), continuously operational through the pandemic, excellent online reputation (overall score of 8 or higher on Booking), and applying revenue management techniques.

The data reflects occupancy and RevPAR trends and the prior year and is sourced from revenue management software Revolution Plus on a sample of hotels employing Franco Grasso Revenue Team’s consultancy services.

As the graph depicts, while occupancy rates plummeted in March, April, and May as a nationwide lockdown was instated and extended, from June onwards city hotels saw a remarkable recovery, followed by a new decline in the latter half of October, with Europe in the throes of the second wave of coronavirus.

From October onwards, the decline was substantial, but not nearly as disastrous as it was in March, April, and May. This can be explained at least partly because the containment measures were less stringent than those implemented during the Spring 2020 lockdown.

The Impact on Overall Results: Opening vs Closing

There are two main points worth focusing on.

1. The outstanding performance over the Summer enabled the properties in the sample examined to generate enough revenue to recoup most of the losses incurred in the first and second waves, thus recording a positive GOP at year-end or at least maintaining a balanced budget (income and expenditure).

2. Properties were performing at two different speeds during the Summer recovery. Some properties with excellent online reputation and visibility, remained operational, applied revenue management, reinvented themselves and adjusted to the “new normal” by targeting new segments. By doing this, they were able to mitigate their losses and obtain a larger market share by contrast with other properties that instead failed to evolve, refused to budge on 2019 prices, lacked a strong online reputation (which became even more crucial during the pandemic), briefly reopened at the end of the Summer and suspended operations immediately afterwards, at the start of the second wave, or never reopened at all.

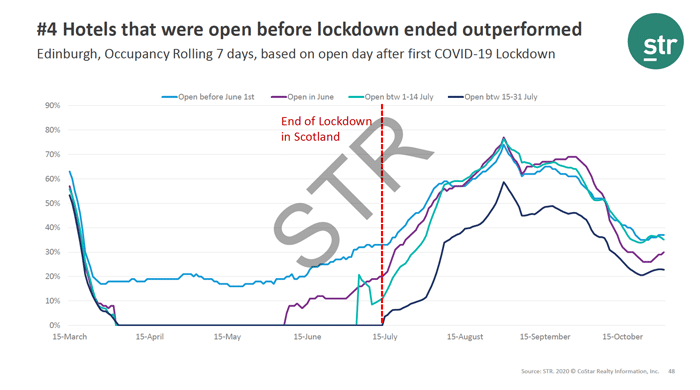

On the subject of opening vs. closure, global benchmarking company STR underscored how those properties that remained operational through the lockdown period performed far better during the Summer – when restrictions began to ease and leisure travel resumed – in contrast to those properties that only resumed operations once the lockdown was lifted.

Where is this Demand Coming From?

There may be numerous reasons influencing these results, but there are two main contributing factors deeply interrelated.

Firstly, the demand for cities such as Rome, Milan, Florence, etc., is constant all year round, and this fact remained unchanged even though the pandemic.

Secondly, while the leisure segment – the largest and most profitable – saw a partial bounce back during the Summer, after countries started easing travel restrictions, several non-leisure segments escaped the first and second wave relatively unscathed, delivering a strong performance.

So, notwithstanding the pandemic-related restrictions, a segment of the population continues to travel and is often exempt from limitations because of an essential need or function.

Business Customers Kept Travelling

The prime example would be typical business customers who travel between Monday and Thursday, driving the weekdays’ occupancy rates. Perhaps, professionals with offices in specific locations or who need to attend scheduled in-person work meetings cannot be postponed or replaced by alternative arrangements, despite the increasing popularity of remote virtual communication.

Many other travellers fall within this category, including:

- Skilled personnel who must carry out works at specific job sites

- Travelling members of the media

- “Day use” customers who need a room only for a few hours during the day

- Smart workers whose work cannot be performed from home and require a suitable working environment

- Patients travelling for imperative medical reasons (examinations, surgery)

- Healthcare professionals

This short list is far from exhaustive, but it serves the purpose of proving the point that many people travel for non-touristic purposes.

How to Benefit from This Continuous Demand of Travelers?

All of these people, whose travel is essential, require overnight accommodation. So, how can hotels capitalize on this demand?

In this scenario, where there is a continuous demand, primarily distributed across online channels, not having an online presence and not being available for bookings negatively impacts the conversion rate, which affects the ranking algorithm of online channels and ultimately the listing visibility. On the other hand, staying visible and available for bookings and capturing reservations (therefore conversions), while potentially boosting the online rating with good customer reviews, creates the right conditions for a property to achieve better visibility and positioning in the medium long term.

Another relevant aspect to consider is corporate or habitual customers who regularly lodge at a specific hotel for work-related purposes. When hotels catering to this clientele suspend operations for reasons related to COVID-19, competing hotels that remain open are primely positioned to capture the existing demand and potentially retain it long term by meeting and exceeding customer service expectations.

Is this Demand Level Sufficiently High?

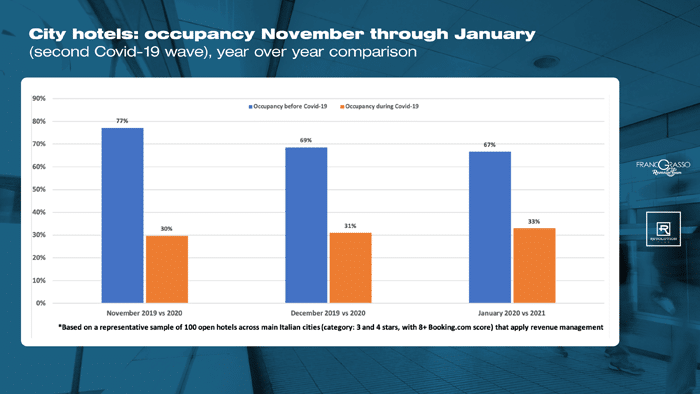

A closer analysis raises some legitimate questions about the segments that generated consumer demand for hotels both during the first lockdown in Spring and during the second wave of November/December 2020 (and through January 2021, as depicted in the chart below)

Is this demand strong enough to generate profit margins and average daily rates comparable to pre-pandemic levels? Evidently NOT.

Is this demand enough to cover at least a portion of fixed costs and ride out the storm? Absolutely YES.

It is crucial to have – on the one hand – a viable cost optimization strategy, adequately managing externalization and internalization. On the other hand, targeted marketing, sales, and revenue management strategy capture any existing demand. Additional features and services can help upsurge your materialization rate even further, mainly through search filter optimization (e.g. good brand reputation, the overall score of 8 or higher, preferably 9 or higher, excellent WiFi, outstanding cleaning and room service, restaurant service or alternative areas for consumption of food and beverages as most restaurants are closed, suitable workspaces, sufficient parking, etc.).

Before COVID-19, at normal market conditions, the demand level was high enough to guarantee an even distribution across all properties. However, in periods of low demand, with competitive pricing across the board, properties with better ratings, reviews, and services become even more visible and desirable and better positioned to capture larger shares of the existing demand.

What to Anticipate Moving Forward

We all can and should undoubtedly look forward to better times ahead.

Sooner or later, restrictions on mobility will be lifted, depending on the improvement of the epidemiological situation or the successful curbing of virus propagation due to higher immunity levels in the population (through infection or vaccination). This might also become an expedient measure, as the collateral health damages (not to mention social and financial) of implementing restrictions on public life indefinitely could prove to be far worse than the virus itself.

And as soon as travel restrictions begin to ease, borders reopen, and flights are allowed to resume regular services, there is no reason not to expect a swift upswing in the tourism and leisure industry, as was indeed the case last Summer. If anything, the pent-up desire for travel will likely increase even more the longer people remain housebound.

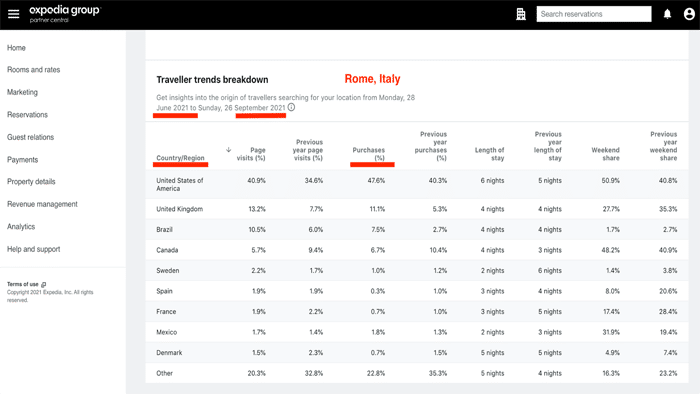

As reported in this article, the signs for cities are fairly encouraging from May 2021 onwards.

The chart below shows that European and American travellers have started booking again with some regularity.

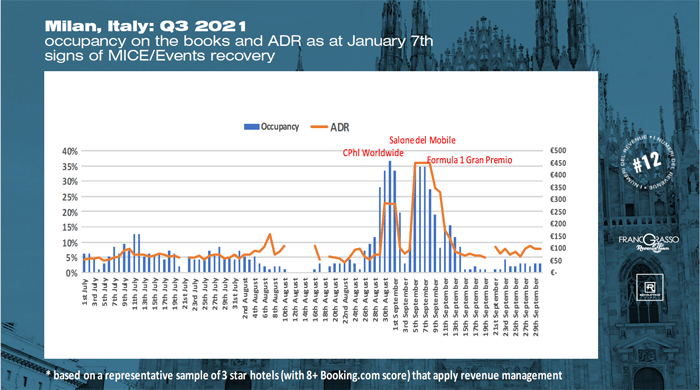

Encouraging Signs of Rebound

In the second half of the year, where major international conventions and trade fairs are scheduled to take place, bookings are picking up at extraordinary rates, possibly signalling a potential sharp recovery of the MICE sector.

So, the market shows encouraging signs of a rebound, yet the benefits of this recovery will not be evenly distributed, and not all players will experience the same positive momentum. Hotels that have always remained operational will be the first to reap the benefits. Therefore, it is crucial to develop and fine-tune pricing, sales, and marketing strategy to be primed for action when the right time comes.

Staying Open vs Closing

Now that we have reviewed the data, let us revisit the question from earlier. Supposing that the appropriate sales strategies and best practices are put into place, is it beneficial for city hotels to remain open during the pandemic? The answer is YES.

One year after the beginning of the pandemic, there is reasonable certainty and statistical evidence to support the claim that suspending operations would undoubtedly lead to more significant losses and hurt a hotel’s ranking, conversion rate and online visibility.

Free Ebook: 10 Things To Know About Revenue Management

This ebook is an introduction to revenue management for executives, general managers and hotel owners. Within the ebook “10 Things To Know About Revenue Management”, you’ll learn the principals of revenue management. Click here to download the Guide "10 Things To Know About Revenue Management".

Properties that choose to remain operational with an adequate business strategy, can at the very least reach their break-even point. Ultimately, properties that close can expect to be negatively affected in the short, medium, and long term. With overall damages increasing the longer they remain closed (due to the extended period of online invisibility).

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment