EBITDAR is a financial metric that stands for earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs. It is sometimes used by hospitality businesses to assess financial health. As a metric, EBITDAR is important because it helps to level the playing field when comparing businesses with different structures and rent costs. This allows financial assessments to focus on core operational performance.

In this article, you can find out more about what EBITDAR is and how to calculate it. You can also get a better sense of how tracking EBITDAR may be of benefit to hotel leaders and investors.

Table of Contents:

- What Is EBITDAR in the Hotel Industry?

- Why Is EBITDAR Important for Hotel Financial Analysis?

- 6 Essential EBITDAR Facts Every Hotelier Should Know

- How to Calculate EBITDAR for Your Hotel: A Step-by-Step Approach

- EBITDAR Formula for Hotels

- Hotel EBITDAR Calculation Example

- 5 Key Benefits of Using EBITDAR in Hotel Management

- Industry Examples & EBITDAR Benchmarks for Hotels

- When to Use EBITDAR Instead of EBITDA in Hotel Finance?

- Common EBITDAR Calculation Mistakes to Avoid

- Strategies to Improve Your Hotel’s EBITDAR

- Global Hotel EBITDAR Outlook (2025-2035)

- The Most Used Revenue Management KPIs for Hotels

- Calculate RevPAR and Maximize Your Hotel’s Revenue

- FAQs Related to EBITDAR

What Is EBITDAR in the Hotel Industry?

EBITDAR is a profitability metric, focused on core business operations. It is an acronym, and the full EBITDAR definition is:

‘earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs’.

Many hospitality businesses have unique rent costs, while things like restructuring can complicate the financial picture. EBITDAR removes these, which can make it easier to make meaningful comparisons between businesses.

EBITDAR is similar to another popular metric, called EBITDA. However, EBITDAR specifically excludes costs associated with rent or leasing, which is an area with significant variation for hospitality businesses.

By focusing on the profitability of core business operations, it becomes easier to compare financial outcomes of hotels and other hospitality businesses with vastly different business models.

Why Is EBITDAR Important for Hotel Financial Analysis?

EBITDAR is important for hotel financial analysis because it creates a level playing field for performance comparisons. This is especially useful when two hotels have different structures and ownership models.

For instance, when comparing a hotel that is fully-owned with a hotel that leases the building, EBITDAR removes this difference. As a result, you can more easily assess the operational and managerial effectiveness of the hotels.

This makes EBITDAR an invaluable benchmarking tool for investors and other industry leaders. It can help to provide transparency, which can be especially valuable when weighing up acquisitions or investments.

Video: What Is EBITDAR, and Why Is it Important?

6 Essential EBITDAR Facts Every Hotelier Should Know

What is EBITDAR used for, how do you calculate it, and what are the limitations? The following six key facts can help you navigate the complexities of this metric and understand what it does and does not tell you:

- Calculating EBITDAR: The basic EBITDAR formula is: take your net income and then add back interest, taxes, depreciation, amortization, and costs linked to rent and restructuring. This gives your pre-rent operational profit.

- Non-GAAP Measure: Is EBITDAR a GAAP or non-GAAP measure? It is classed as a non-GAAP measure, but it is a widely used metric, which is especially valuable in the hospitality industry for performance comparisons.

- Benchmark Variations: Segment-specific benchmarking is vital. For example, luxury hotels generally aim for EBITDAR margins of around 42 to 48%, while economy hotels often aim for around 25 to 35%.

- Management Agreements: A hotel management contract may have clauses tied to EBITDAR performance. In many cases, incentives are also offered, based on the percentage of EBITDAR above the target threshold.

- Industry Evolution: After the COVID-19 pandemic, some hospitality businesses began using EBITDARM, which also adds back management fees. This allows owner-operated and third-party managed properties to be compared.

- Analytical Limitations: It is important to note that EBITDAR does not account for capital expenditure requirements, so it can overstate profitability unless you consider replacement reserves too.

How to Calculate EBITDAR for Your Hotel: A Step-by-Step Approach

With the basics of EBITDAR explained, it is important to understand how to calculate EBITDAR for your hotel. This will give you a better understanding of your operating performance. The steps to follow are:

1. Start with Total Revenue

Calculate the total income for your hotel, including revenue earned from room sales, food and beverage sales, spa services, events, on-site parking, and other paid hotel services.

2. Subtract Operating Expenses

Deduct the various operating expenses, including staff wages, utilities, maintenance, supplies, marketing expenses, guest amenities, and costs associated with staff training.

3. Add Non-Operating Expenses

If you previously subtracted them, add back non-operating expenses. Specifically, you need to add back: interest, taxes, depreciation, amortization, and costs associated with restructuring, rent or lease payments.

EBITDAR Formula for Hotels

The following EBITDA formula will help you understand this calculation more:

EBITDAR = Net Income + Interest + Taxes + Depreciation + Amortization + Rent/Restructuring Costs

This will provide you with your hotel’s earnings before the impact of taxes, ownership arrangements, etc.

Video: EBITDAR (Meaning) | Formula | Calculation with Example

Hotel EBITDAR Calculation Example

Here, you can find a practical example of how to calculate EBITDAR for a 150-room full-service hotel:

Financial Data (Annual):

- Total Revenue: $8,500,000

- Net Income: $850,000

- Interest Expense: $425,000

- Income Taxes: $275,000

- Depreciation: $550,000

- Amortization: $75,000

- Property Lease: $1,200,000

- Equipment Leases: $125,000

EBITDAR Calculation:

Here is how you can calculate EBITDAR:

EBITDAR = $850,000 (Net Income) + $425,000 (Interest) + $275,000 (Taxes) + $550,000 (Depreciation) + $75,000 (Amortization) + $1,200,000 (Property Lease) + $125,000 (Equipment Leases)

EBITDAR = $3,500,000

You can calculate the EBITDAR margin using this formula:

EBITDAR Margin = EBITDAR / Total Revenue

$3,500,000 / $8,500,000 = 41.2%

You can calculate the EBITDAR per available room using this formula:

EBITDAR per Available Room = EBITDAR / Total Rooms

Industry benchmarks suggest this would be slightly below par for a luxury hotel, where the target would generally be 42 to 48%, but strong for an upper-upscale hotel, where the target would be around 38 to 44%. However, context matters, and factors like location, target market, and property age can all impact performance expectations.

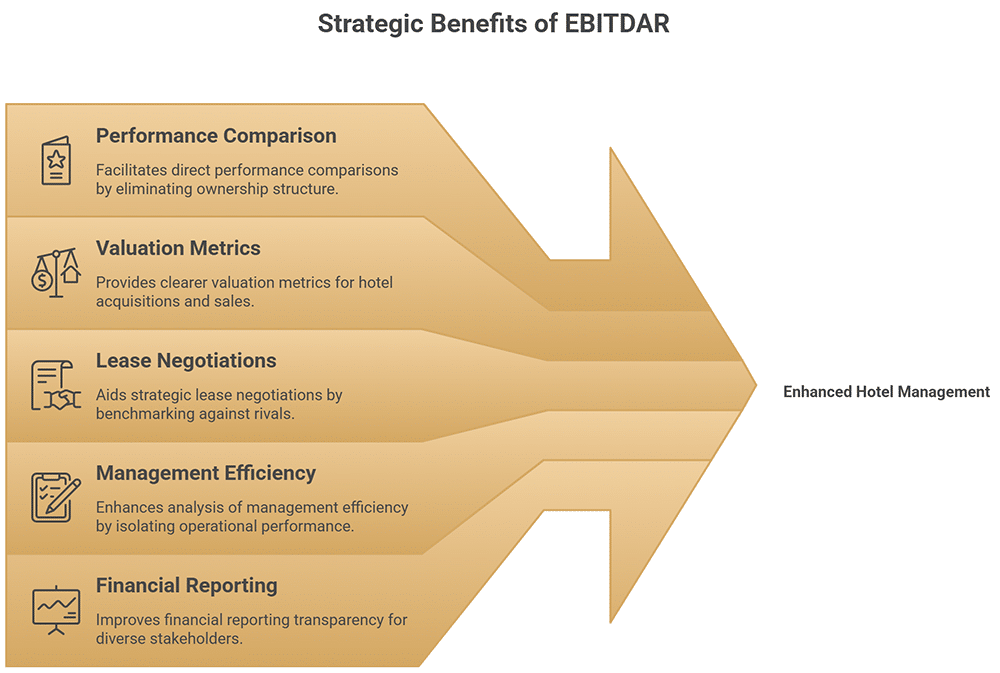

5 Key Benefits of Using EBITDAR in Hotel Management

There are a number of benefits associated with calculating EBITDAR, and understanding these advantages can help with your decision-making. Here are five of the most significant benefits of using this metric:

1. Apples-to-Apples Performance Comparison

One of the biggest advantages of EBITDAR is its ability to facilitate more direct comparisons between hotels. In particular, eliminating ownership structure from the equation allows you to focus on comparing performance.

This is important because real estate arrangements and restructuring can significantly alter financial outcomes. While this is useful to know, sometimes you want to compare the operating performance without these factors.

The hotel industry EBITDAR benchmark metric is not only vital for comparisons with rivals, but also for assessing performance within a diverse hotel portfolio. You can use it to understand the hotels that are performing well operationally and the ones that require intervention, without information being skewed by structural variations.

2. Clearer Valuation Metrics for Acquisitions

For anyone interested in acquiring or selling a hotel, EBITDAR can be a useful metric for arriving at a valuation. Rent is often a big expense for hotels, but it is beneficial to understand performance before these costs.

In fact, EBITDAR is so useful for valuation that it is often used to provide the basis for a purchase price. For example, it is not uncommon for a property to be valued at around 8 to 12 times the EBITDAR value.

Essentially, focusing on EBITDA allows you to narrow your focus to what you are really buying or selling. It helps to define the operational success of the business, away from real estate distortions.

3. Strategic Decision-Making for Lease Negotiations

If a hotel is operating under a lease agreement, EBITDAR can be invaluable during negotiations. If you can benchmark your hotel against rivals, you can more easily determine whether rental terms need to be adjusted.

This can be critical during times of financial difficulty, such as an economic recession. During these difficult periods, it may be necessary for a hotel to try to negotiate a rent reduction.

Having EBITDAR figures alongside your other financial figures can help you to make this point more strongly. It allows hoteliers to negotiate with landlords while demonstrating how rental costs are affecting financial viability.

4. Enhanced Analysis of Management Efficiency

Another reason EBITDAR is so valuable for hoteliers is that it helps to focus attention on managerial performance. Core operations are, after all, the aspects of running a hotel that management has direct control over.

As a metric, EBITDAR allows you to isolate operational performance and keep it distinct from financial issues, government-related expenses, and real estate factors. This is important for seeing changes in day-to-day performance.

When EBITDAR figures show a drop in financial performance, you can more easily take action. At the same time, if EBITDAR figures look good but overall financial performance does not, it helps you to know it is a non-operational issue.

5. Improved Financial Reporting for Stakeholders

Hotels often have many stakeholders, from investors to management companies, and they will all want transparency around business results. EBITDAR offers additional clarity when it comes to your hotel’s financial health.

The EBITDAR metric makes it relatively easy to communicate changes in pure operational performance. It is also reasonably simple to understand for stakeholders who may have different priorities.

EBITDAR can also be used by business leaders to calculate incentives. When used in this way, the hotel manager may be paid extra money when EBITDAR figures are a certain percentage above the target amount.

Industry Examples & EBITDAR Benchmarks for Hotels

EBITDAR benchmarks can help you contextualize your own hotel financial reports. Although context is crucial and targets can vary depending on factors like location and hotel size, the following figures serve as useful EBITDAR margins to aim for when running different types of hotels:

- Luxury hotels: 42-48% of total revenue

- Upper-upscale properties: 38-44%

- Select-service hotels: 32-40%

- Economy properties: 25-35%

Using these generalized benchmarks, you can get some idea about whether your property is performing above or below industry expectations, based on the hotel segment you are in.

As a metric, EBITDAR can be especially crucial when deals are being negotiated that include real estate investment trusts (REITs), leaseback models, or management contracts.

It is also a valuable way of benchmarking operating profitability across the general hotel landscape. In fact, EBITDAR and related metrics like EBITDA and adjusted EBIDTA are often reported by major brands, including Marriott, Hilton, and Hyatt, because they allow managed and franchised hotels to be compared.

When to Use EBITDAR Instead of EBITDA in Hotel Finance?

EBITDAR and EBITDA are both useful metrics, but knowing when to use EBITDAR instead of EBITDA is crucial. Examples include when comparing leased and owned properties and when valuing a property before acquisition or refinancing.

It is useful for meaningful comparisons between leased and owned properties because it gives a fairer starting point. Eradicating variables like rent allows you to focus on the profitability of core hotel functions.

Meanwhile, during acquisitions and refinancing, EBITDAR can be more useful than EBITDA for actually arriving at a valuation. In many cases, this will be around 8 to 12 times the EBITDAR value, with luxury properties generally commanding 10 to 12x multiples, while limited-service hotels command around 8 to 10x multiples.

By contrast, EBITDA may be a more useful metric when exploring earnings available to the business. It can also be a better metric to focus on if a company owns most of its assets, making rent minimal or irrelevant. If you want to learn more about EBITDA, check out our article “What Does EBITDA Stand for?”

Common EBITDAR Calculation Mistakes to Avoid

The following are some of the most common mistakes people make when calculating EBITDAR. Learning to avoid these pitfalls can prevent distortions in your financial results and benchmarking:

- Inconsistent Rent Classification: You must make sure all property-related lease expenses are included when adding the rent component of your EBITDA calculation.

- Confusion Around Equipment Leasing: Some hotels neglect to factor in equipment leases when adding back rent. You need to consider all leases and rentals when calculating EBITDAR.

- Treatment of Management Fees: You have to be consistent with whether management fees are included before or after EBITDAR. One possibility is to use EBITDARM, so management fees are added back separately.

- One-Time Item Inclusion: Account for unusual and non-recurring expenses. Failing to do this can lead to misleading results and issues when making year-on-year comparisons.

- Inconsistent Application: Make sure you document your approach to calculating EBITDAR and apply this consistently. To analyze trends, you need to use the same approach for all reporting periods and all hotel properties.

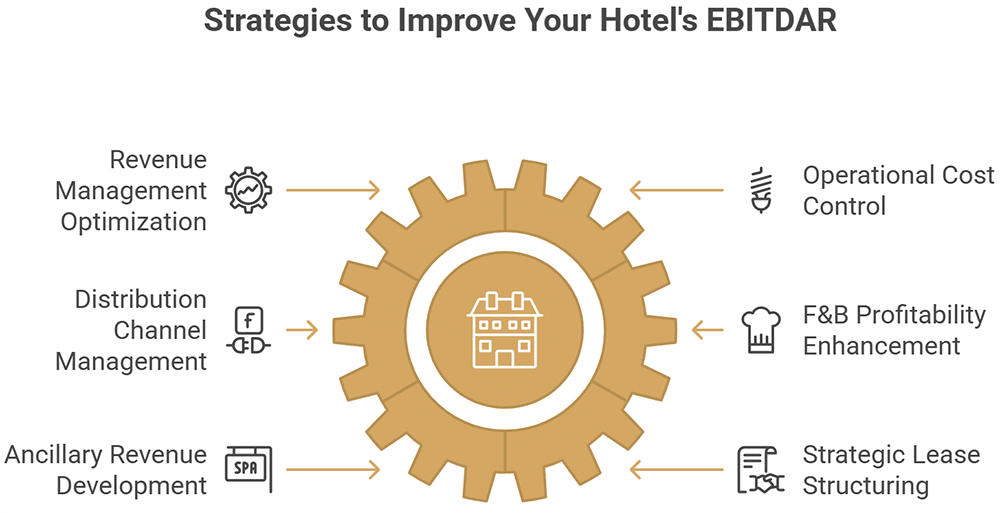

Strategies to Improve Your Hotel’s EBITDAR

The following strategies can be implemented to improve your hotel’s EBITDAR results. As a result, you have the potential to boost your financial position and the market value of your property:

- Revenue Management Optimization: Make use of dynamic pricing, rate plans that are specific to your hotel segment, and other strategies to maximize your revenue per available room (RevPAR).

- Operational Cost Control: Look into areas like energy consumption, procurement, and workforce scheduling. See if you can find inefficiencies or opportunities to reduce costs without harming the guest experience.

- Distribution Channel Management: Look into the performance and cost effectiveness of channels like OTAs. Focus marketing efforts on promoting direct bookings and channels with lower commission fees.

- F&B Profitability Enhancement: Look at supplier contracts, portion sizes, and other areas to see if you can improve food and beverage margins. This could boost EBITDAR performance without hurting customer satisfaction.

- Ancillary Revenue Development: Consider creating packages and upselling spa services, visits to local attractions, or premium in-room entertainment to increase the average revenue generated from each guest.

- Strategic Lease Structuring: Whenever possible, look to agree on percentage-based rent components, aligning property costs with hotel performance. This can protect you in the event of market fluctuations.

Global Hotel EBITDAR Outlook (2025-2035)

The global outlook for the hotel industry over the coming years suggests big changes in expected EBITDAR calculations. In the short term, net operating income is expected to compress by 0.6% in 2025, according to CBRE.

This is largely because, for many, costs are rising faster than revenue is. However, there are also signs of improvement on the horizon, as hotels achieve greater efficiency, albeit with uneven effects.

For example, PwC highlights a trend where luxury hotels are substantially outperforming economy hotels. In the first third of 2025, RevPAR in the luxury segment grew by 7.1%, compared to 0.9% in the economy segment.

Meanwhile, McKinsey research draws attention to a trend outside of the luxury hotel segment, where ‘asset-light’ models are in ascendancy. Large hotel brands are increasingly turning away from ownership, towards franchising and management as a means of scaling their businesses, further increasing the relevance of EBITDAR.

The Most Used Revenue Management KPIs for Hotels

EBITDAR may be one of the most valuable financial performance metrics for many hotels, but it is far from the only KPI worth tracking. Other examples include revenue per available room (RevPAR), average daily rate (ADR), occupancy rate, and gross operating profit per available room (GOPPAR).

In “The Most Used Revenue Management KPIs for Hotels”, you can access an overview of the most critical KPIs to focus on, complete with details on what these metrics tell you and why they matter.

Calculate RevPAR and Maximize Your Hotel’s Revenue

In addition to calculating and tracking EBITDAR, hotels should continually monitor revenue per available room, or RevPAR for short. This is one of the single most important metrics in any hotel, as it tells you not only how much you are earning for rooms in your hotel, but also how well you are filling these rooms.

In the “Calculate RevPAR and Maximize Your Hotel’s Revenue” article, you can discover how to calculate RevPAR, how frequently you should review it, what a good RevPAR looks like, and why RevPAR matters so much.

FAQs Related to EBITDAR

EBITDAR can help you make important decisions around operations, investments, and the valuation of a hotel. It is an important financial metric because it levels the playing field and allows properties with vastly different ownership structures to be meaningfully compared on an operational basis.

Did You Like This Article About EBITDAR Calculation?

You might also be interested in the following articles:

- Revenue Management Strategies to Grow Your Hotel Business

- Forecasting Tips to Improve Your Revenue Management Strategy

- Open Pricing: Why Is It the Next Hotel Revenue Management Strategy

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment