Earnings before interest, taxes, depreciation, amortization, or EBITDA for short, is a KPI becoming increasingly prevalent in hotel management. Sometimes referred to as operating cash flow, the metric can be used to determine the operational profitability of a business, taking into account only its key daily running costs.

In this article, you’ll learn what EBITDA means for hotels, how it is calculated, key benchmarks, and why it has become essential for measuring profitability today.

Table of Contents:

- What Is EBITDA?

- Why Is EBITDA Important?

- EBITDA Calculation

- What Is an Example of EBITDA?

- Uses and Limitations

- Tips to Optimize EBITDA in Hotel Revenue Management

- EBITDA vs. Other Hotel KPIs

- The Advantages of Tracking EBITDA in Hotels

- How Major Hotel Chains Increase EBITDA with Smart Strategies

- Global Hotel Industry EBITDA Outlook: 2025-2035

What Is EBITDA?

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to evaluate a company’s operating performance by removing the effects of non-operational decisions. According to industry benchmarking data, average hotel EBITDA margins range from 16% for smaller properties to 20% for large hotels. Public hotel companies typically trade at EBITDA multiples near 27x, which helps investors and operators benchmark performance.

This table explains each component typically excluded when calculating EBITDA and the rationale behind its exclusion. Understanding these exclusions helps clarify how EBITDA provides a clear view of a business’s core profitability, unaffected by financing structure, tax implications, and non-cash accounting practices like depreciation and amortization.

| Component | Definition | Why It’s Excluded in EBITDA |

|---|---|---|

| Interest | The cost paid on borrowed funds. | Excluded to show earnings without the influence of financing and interest costs. |

| Taxes | Payments are made to local, state, or federal governments based on earnings. | Excluded to provide a view of operational profitability independent of tax rates and benefits. |

| Depreciation | The allocation of the cost of tangible assets over their useful lives. | Excluded to reflect earnings without the impact of historical capital expenditures. |

| Amortization | The expensing of intangible assets (like patents or goodwill) over their useful life. | Excluded to focus on current operational profitability without the effects of past investments in intangibles. |

Video: What Is EBITDA?

Why Is EBITDA Important?

EBITDA has emerged as an important metric for certain types of businesses, including those in the hotel industry, to keep track of because it is a way of assessing basic day-to-day operational profitability. Eliminating expenses like interest, taxes, depreciation, and amortization from the metric means that performance can be viewed away from accounting, financing, and political decisions, which can otherwise distort financial results.

While hotel revenues have bounced back strongly after COVID-19, the challenge lies in profitability. For example, according to CBRE, in 2024, EBITDA per available room only rose by about 2.5%, compared to overall revenue growth of nearly 7.2%. According to STR analysis, rising labor costs, which have increased more than 20% since 2019, and insurance expenses, up by around 15%, are squeezing margins. These pressures have pushed EBITDA into the spotlight as a vital guide for hotel chains when shaping operations, investments, and long-term growth strategies.

EBITDA Calculation

The earnings before interest, taxes, depreciation, and amortization (EBITDA) KPI can be calculated with the following formula:

EBITDA = Total Revenue – Expenses (excluding interest, taxes, depreciation, and amortization).

Video: How to Compute EBITDA in 2 Minutes

What Is an Example of EBITDA?

An example of an EBITDA calculation in the hotel industry is as follows:

Total hotel revenue: $2,000,000

Net income: $1,200,000

Interest expenses: $40,000

Taxes: $400,000

Depreciation and amortization: $20,000

To calculate EBITDA, a hotel adds net income, interest expenses, taxes, and depreciation and amortization together.

$1,200,000 + $400,000 + $40,000 + $20,000 = $1,660,000.

EBITDA = $1,660,000.

The hotel can also calculate its EBITDA margin by dividing EBITDA by total hotel revenue, then multiplying by 100.

($1,660,000 / $2,000,000) x 100 = 83%.

Uses and Limitations

EBITDA is useful for large businesses, especially those with many assets, and is also popular among companies with significant debts. This is because it shows creditors the amount of money available to pay interest and demonstrates potential profitability when accounting and financing decisions are removed.

It is also useful for comparing financial performance against businesses in other regions or industries, where taxes and expenses may differ significantly, which is why it has taken off as a KPI in the hotel industry.

With that being said, EBITDA is not yet recognized as one of the generally accepted accounting principles (GAAP). It is also possible to manipulate the metric to make a hotel look more profitable than it actually is, meaning the KPI may not present an accurate picture of true financial performance.

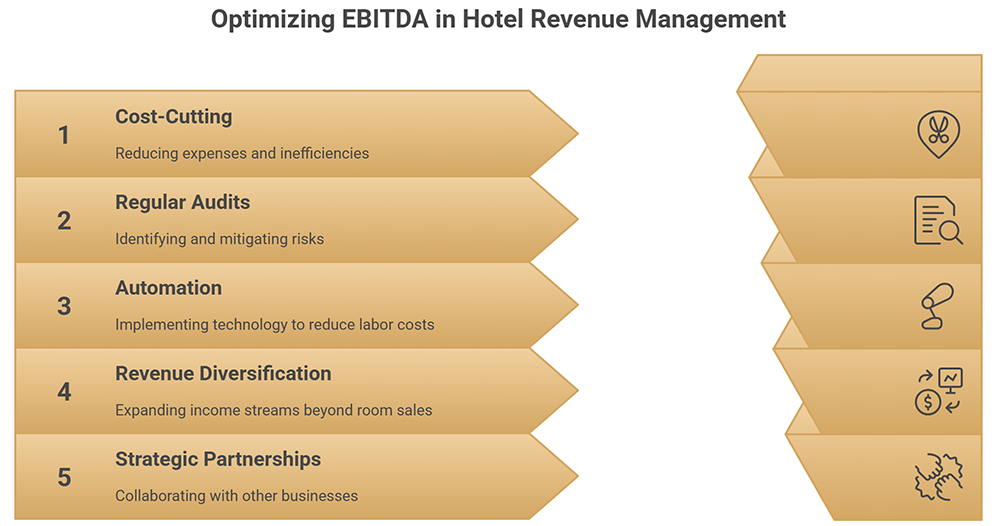

Tips to Optimize EBITDA in Hotel Revenue Management

Below, you can access some helpful tips that can assist you in optimizing your EBITDA.

1. Cost-Cutting

One way to optimize EBITDA is to focus on cutting costs. In the short term, this could include focusing on local suppliers, reducing labor costs, and addressing operational inefficiencies. In the longer term, cost-cutting could also involve tactics like switching to renewable energy, where short-term expense leads to long-term savings.

According to CBRE’s analysis, hotel operating expenses are increasing faster than revenues, with “expenses above GOP rising 4.1% in 2024, while expenses below GOP grew by 3.6%, both outpacing total hotel revenue growth of just 2.3%”. The most critical area for cost optimization is labor management, where hotels are paying 22.1% more for compensation while working 7.4% fewer hours since 2019.

Robert Mandelbaum, Research Director for CBRE Hotels Research, emphasizes:

“Our focus on right-sizing the business is not just about cost-cutting; it is about implementing prudent business practices, eliminating non-essential costs and services, and reducing waste.”

2. Regular Audits

Carrying out regular audits can help hotels to avoid a number of potentially costly issues, including cyber attacks, compliance issues, and fraud, boosting EBITDA. In addition to mitigating risks, audits can also help you understand where you are spending money and where that expenditure could be reduced without hitting the guest experience.

Aku Kwarteng, Director and founder of Paperchase Accountancy, explains:

“Essential hotel audit practices for compliance in the hospitality industry include comprehensive financial reviews that directly impact EBITDA performance.”

3. Automation

Introducing technology that allows manual tasks to be carried out automatically can help to reduce labor costs and can free up time to focus on tasks that generate revenue and boost EBITDA. For example, you can use a revenue management system to automate price adjustments or use AI chatbots to automate aspects of customer service.

According to Market Research Intellect, the global hotel automation market is projected to reach $27.2 billion by 2031, growing at 8% annually. Hotels implementing AI-driven dynamic pricing systems report 10% year-over-year ADR increases with reduced manual intervention requirements.

More significantly, mid-sized hotels investing $350,000 in AI infrastructure can generate $855,000+ in annual profit improvements through operational efficiencies that directly enhance EBITDA margins. Automation not only saves time but also allows staff to focus on high-value, guest-facing tasks.

4. Revenue Diversification and Total Revenue Management

Revenue diversification is a smart way to improve EBITDA. Instead of relying only on room sales, hotels can grow income through F&B outlets, spas, events, and partnerships. Total Revenue Management helps balance and maximize all revenue streams, ensuring every part of the property contributes to profitability. According to STR’s analysis, hotels that adopt holistic revenue approaches see “GOP growth consistently 1.5 to 2 times the growth rate of revenues.“

Franco Grasso, revenue management expert at Revenue Team, notes that

“Revenue management helped hotels stay the course during the lockdowns and minimize losses, with many city hotels maintaining revenue strategies and breaking even despite the pandemic.” He emphasizes that “smart revenue management may increase variable costs and revenue at the same time, so profit grows through strategic diversification approaches.”

5. Strategic Partnerships and Technology Integration

Forming strategic partnerships and using technology can greatly improve EBITDA. According to McKinsey, partnerships with other businesses and tech providers can increase EBITDA by 15–25% through shared resources, reduced costs, and expanded customer reach. Hotels can partner with local businesses, travel companies, or online platforms to reach new guests and create extra revenue opportunities.

At the same time, investing in technology such as automated check-ins, smart energy systems, and advanced revenue management tools reduces costs and boosts efficiency. According to Deloitte’s European Hotel Industry Survey, “39% of executives expect to partner with other organisations both in and outside the hospitality sector in 2025 compared to 19% a year ago.” Together, partnerships and technology strengthen both guest satisfaction and overall profitability.

EBITDA vs. Other Hotel KPIs

KPI stands for Key Performance Indicator. With KPI, you can measure and identify areas of success and failure, as well as trends related to demand and customer behavior. Besides EBITDA, other important Revenue Management KPIs are:

EBITDA vs. RevPAR (Revenue per Available Room)

RevPAR shows how well a hotel earns from rooms, but EBITDA shows how much of that becomes profit. A hotel may have high RevPAR through premium prices but still poor EBITDA if running costs are too high. For more information about this revenue management KPI, read “What Is RevPAR?”

EBITDA vs. ADR (Average Daily Rate)

ADR measures room price strength, but EBITDA includes all revenue streams and operational costs. A hotel can maintain a strong ADR yet see profit margins shrink if labor or operating costs rise. This makes EBITDA essential for real performance assessment. For more information about ADR, read “Hotel KPIs explained: ADR, REVPAR, and GOPPAR.”

EBITDA vs. GOPPAR (Gross Operating Profit per Available Room)

GOPPAR measures departmental profitability, but EBITDA provides the whole business’s operational performance. EBITDA excludes financing and accounting decisions, making it easier to compare properties with different capital structures or ownership models.

EBITDA vs. Occupancy Rate

Occupancy shows how many rooms are filled, but not how profitable they are. High occupancy with low EBITDA points to pricing or cost problems. EBITDA helps find the best occupancy for profit, not just full rooms. If you want to learn more about occupancy rate, read our article “What is an Occupancy Rate?”

EBITDA vs. TRevPAR (Total Revenue per Available Room)

TRevPAR includes all revenue streams, while EBITDA shows what’s left after operational costs. A hotel can have strong TRevPAR but low EBITDA if costs are poorly managed, proving that cost management is as important as revenue generation. If you want to find more information about this revenue management KPI, read “What is TRevPar?“

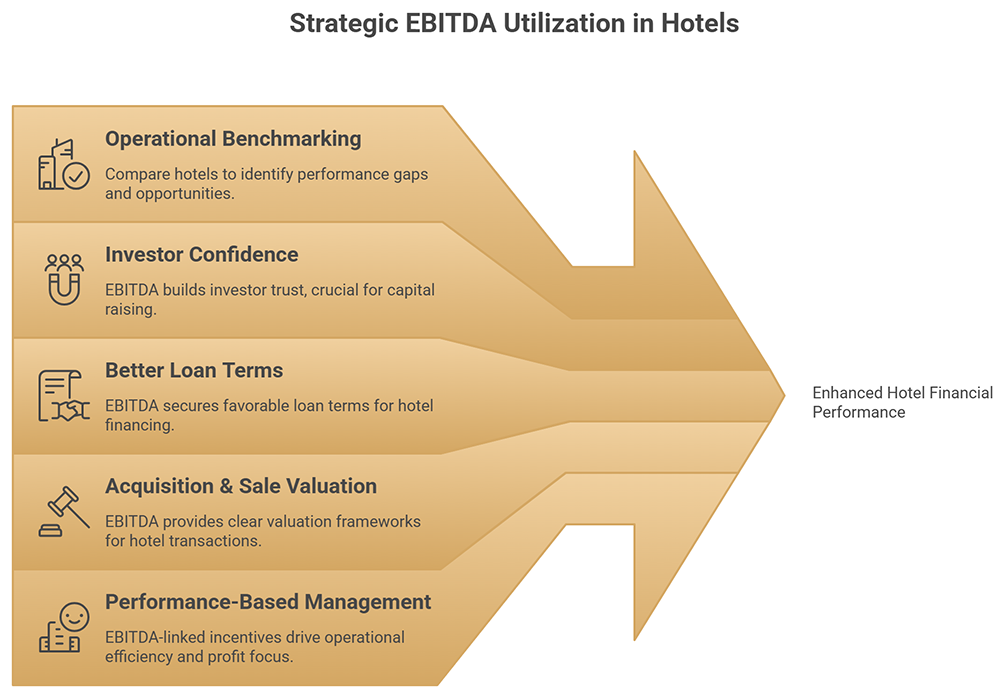

The Advantages of Tracking EBITDA in Hotels

Tracking EBITDA gives hotels a clear view of financial health. It helps measure performance, attract investors, secure funding, and make better business decisions.

- Operational Benchmarking: Compare similar-sized hotels in different locations regardless of ownership structure, financing arrangements, or tax jurisdictions to identify performance gaps and optimization opportunities.

- Investor Confidence: Investors value EBITDA as a reliable metric of profitability, with industry data showing hotel EBITDA multiples averaging 27x for public companies, making it essential for capital raising.

- Better Loan Terms: Lenders often base hotel financing decisions on EBITDA levels, as it demonstrates available cash flow for debt service without accounting complexities that can distort financial performance.

- Acquisition & Sale Valuation: EBITDA multiples are standard in hotel transactions, with industry benchmarks ranging from 21.3x to 27.8x depending on property size, providing clear valuation frameworks for deals.

- Performance-Based Management: Incentive programs for general managers can tie bonuses to EBITDA growth, creating accountability for operational efficiency while focusing leadership on profit optimization rather than just revenue generation.

How Major Hotel Chains Increase EBITDA with Smart Strategies

Top hotel chains like Marriott and Hyatt use smart business models to grow EBITDA. Their strategies show how hotels can increase profits while keeping costs low.

Marriott International: Asset-Light EBITDA Optimization

Marriott proves how an asset-light model can increase profits. The company owns or leases less than 1% of its hotels. Instead, it makes money mainly through management fees (3–5% of hotel revenue) and franchise fees (4–7% of room revenue). This approach helped Marriott reach $1.229 billion in adjusted EBITDA in Q3 2024, an 8% increase from the previous year. With over 9,000 hotels worldwide, Marriott enjoys stable income and strong cash flow. As hotels earn more, Marriott collects higher fees without adding major costs, which boosts profit margins and keeps growth steady.

Hyatt Hotels Corporation: Transformation Through Strategic Repositioning

Hyatt improved its EBITDA by changing its business model. The company bought Playa for $2.6 billion and sold $2 billion worth of real estate. These moves created 50-year management agreements and brought in $200 million in preferred equity. Hyatt now aims for 80% of its revenue to come from management and franchise fees. For 2025, the company expects EBITDA of $1.085–1.130 billion, up 7–11% from the previous year. This strategy lowers risks from market changes and creates steady, recurring income. By focusing on long-term agreements, Hyatt builds stronger profits and makes its business more reliable for investors.

Global Hotel Industry EBITDA Outlook: 2025-2035

The next decade presents a transformative period for hotel EBITDA performance globally. Technology integration will be the primary driver of margin improvement, with AI-powered revenue management, automated operations, and predictive maintenance systems reducing operational costs by an estimated 15-20% by 2030, according to HFTP.

Sustainability investments, while initially margin-negative, are expected to yield positive EBITDA returns by 2028 through energy cost savings and premium pricing capabilities. According to the Sustainable Hospitality Alliance, hotels that prioritize sustainability reduce operating costs by up to 30%.

Market consolidation will continue reshaping EBITDA benchmarks, as larger operators achieve economies of scale that smaller independents cannot match. According to CBRE analysis, Asia-Pacific markets will lead EBITDA growth with projected annual improvements of 3-5%, driven by rising middle-class travel demand and infrastructure development. European markets will see modest 1-2% annual EBITDA growth, constrained by regulatory costs and labor market challenges.

Climate adaptation investments will become EBITDA-neutral by 2032, as properties that fail to adapt face higher insurance costs and reduced competitiveness. Extended-stay and alternative accommodation formats will achieve superior EBITDA margins, driving portfolio shifts among major operators.

As Amanda Hite, President of STR, puts his thoughts on EBITDA Margin Outlook:

“Annual GOP and EBITDA margins are forecasted to improve slightly year over year. For 2025, higher growth is expected across both metrics due to lower labor costs, which are set to decrease slightly for a majority of the chain scales. Upper Midscale chains are still expected to maintain the lowest labor costs this year, with 2025 levels forecasted to come in $168 lower than Luxury chains.”

By 2035, successful hotel operators will achieve EBITDA margins 200-300 basis points higher than 2025 levels through operational excellence and strategic positioning.

FAQs: EBITDA Calculation

EBITDA has become the primary indicator of hotel operational health. Successful hoteliers must prioritize EBITDA optimization through technology adoption, operational excellence, and strategic positioning to achieve sustainable profitability growth in an increasingly competitive landscape.

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment